Submitted by Wendell Potter on

Earlier this week I asked you to send thank-you notes to one of America's biggest health insurers for helping to shed light on an important policy matter. If you did, thank you, but please don't put your good stationery away just yet. You need to write yet another note of gratitude -- this time to our state insurance commissioners. This morning they did the right thing for consumers when they refused to cave in to intense pressure from the profit-obsessed insurance industry to gut an important provision of the health care reform law.

Earlier this week I asked you to send thank-you notes to one of America's biggest health insurers for helping to shed light on an important policy matter. If you did, thank you, but please don't put your good stationery away just yet. You need to write yet another note of gratitude -- this time to our state insurance commissioners. This morning they did the right thing for consumers when they refused to cave in to intense pressure from the profit-obsessed insurance industry to gut an important provision of the health care reform law.

I wrote on Tuesday that we all should send thank-you notes to the executives at UnitedHealth Group, the country's biggest health insurer. United announced that day that its third-quarter profits were up a whopping 23%, largely as a result of finding ways to spend far less of their customers' premiums on medical care than just a year earlier. The company was happy to report to its shareholders that its medical-loss ratio (MLR) -- which is a measure of how much of the premiums it collected that it actually paid out in claims -- dropped a stunning 3.7%, to 80.9%. It is in investors' best interests for the MLR to go down. The less an insurer spends on care, the more is available for profits. It is not at all a good thing for policyholders, however, which is why Congress included a provision in the health care reform law that, beginning next year, will require insurers to spend at least 85 percent of premiums it collects from its large group customers on medical care. For insurers' individual and small group customers, it is 80%. Insurers that do not meet those minimums will have to issue rebates to their customers.

Congress gave the National Association of Insurance Commissioners (NAIC), a group comprising the nation's top state insurance regulators, the task of recommending to the Department of Health and Human Services (HHS) how the MLR provision should be enforced. The commissioners have been at work drafting the MLR regulations for the past six months. The insurance industry, which tried without success to keep the MLR provision out of the law, thought it could have its way with the commissioners. It has been pressuring them relentlessly to load the regulations up with loopholes so big they would have no trouble meeting the new requirements. Unfortunately for insurers, UnitedHealth's announcement of its big increase in profits, made possible by the big decrease in its MLR, came just two days before the NAIC was scheduled to vote on the recommendations it will send to HHS.

Insurance Commissioners Reject Insurance Industry-Backed Amendments

Timing is everything, especially in politics and policy-making. This morning at the NAIC's fall meeting in Orlando, the commissioners voted to reject all of the insurance industry-backed amendments to the regulations that had been developed in a thoughtful and transparent process at the NAIC committee level. Had United's profit announcement not demonstrated so clearly why the MLR provision was included in the reform law in the first place, the commissioners likely would have been more inclined to weaken the regulations to the point of making the MLR provisions of the law meaningless to consumers.

But that's not the only reason. Several consumer groups were engaged and made a big difference in the outcome by making their points of view known to the commissioners. They did not have anything close to the financial resources the insurance industry had to lobby the NAIC, but they were armed with facts and figures that the commissioners could not ignore.

Good News for Consumers

Today I can say that I am proud to have been one of 28 people selected by the NAIC to represent the interests of consumers this year. The NAIC's vote this morning is clear evidence that the commissioners listened to us. We didn't win all the arguments over the past six months -- the work the NAIC approved this morning represents a compromise between the interests of consumers and the insurance industry -- but we won many of the important ones. The recommendations that will go to HHS will make it easier for insurers to meet the MLR minimums, there's no doubt about that, but they will also help to ensure that most of what we pay in premiums for health coverage will actually go to pay for medical care, not insurance company shareholders and executives. That is a big victory for consumers.

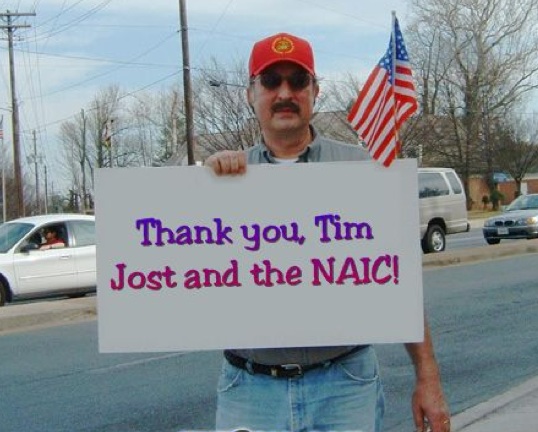

P.S.: While all of the consumer representatives to the NAIC made important contributions to the debate and the final outcome on the NAIC's MLR work, I would like to thank one consumer rep in particular. Tim Jost, professor of law at William & Lee University, was our big gun. No one knows health care law, and the Affordable Care Act of 2010 in particular, better than Tim. He devoted countless hours to making sure consumer interests were heard and heeded. Commissioners frequently asked for Tim's opinions on the often obscure matters being discussed during seemingly endless conference calls over many months. So before you send a thank-you note to your state insurance commissioner, send one to Tim. He is a true champion of the consumer.

P.P.S.: As expected, some critics of the MLR provision--including, of course, America's Health Insurance Plans, one of the industry's big lobbying and fear-mongering groups--were quick to condemn the NAIC's actions, claiming it would reduce consumer choice and health plans' incentive to improve quality. AHIP president Karen Ignagni warned of dire consequences. "Defining health care quality initiatives in a way that is too narrow or static will turn back the clock on progress and create new barriers to investment in the many activities that health plans have implemented to improve health care quality," Ignagni wrote in a statement after hearing of the NAIC's vote this morning. "More specifically, we want to highlight our recommendations for modifying the definition of health care quality initiatives to include fraud prevention and detection programs and the initial startup costs associated with implementing the new ICD-10 coding system."

Nonsense. These regulations will not take away the incentive for health plans to root out fraud and abuse. They already have installed amazingly sophisticated IT systems to detect fraud. I know because I used to write press releases about them. Health plans will not unplug those systems just because they can't categorize their fraud-busting efforts as activities that improve the quality of care. As for expenses related to implementing the new ICD-10 coding system, insurers are required by law to implement them, and not a minute too soon. Every other health care system in the developed world has already put the ICD-10 system in place.

The new MLR regulations might indeed cause a few inefficient health plans to either improve the way they do business or close up shop, but why is that a bad thing? Because it will "reduce choice?" One of the main objectives of reform is to reduce waste and ensure Americans get the value they deserve when they send in their premium payments every month. If the health plans that take our money but give us lousy coverage in return are forced out of the marketplace, I say good riddance, even if their departure means that the bigger and more efficient plans that offer better value pick up the customers they leave behind.

Comments

Nancy Boulicault replied on Permalink

I'm sure you mean well...

Michael Laws, Jr. replied on Permalink

Also, thanks go to you Wendell Potter

DonnaL replied on Permalink

Thank you, Wendell Potter.

Thom replied on Permalink

ICD-10-Coding

Anonymous replied on Permalink

Healthcare

Healthguy replied on Permalink

Reform wasn't reform.. Insurers wanted reform.

Frankie Spain replied on Permalink

Frontline healthcare issues