Submitted by Will Dooling on

At the Mt. View gas station in Wausau, Wisconsin last week, some motorists were able to secure a gallon of gas for $1.84, thanks to a subsidy from David Koch's Americans for Prosperity. These astroturf publicity stunts have taken place at gas stations around the country in recent weeks as part of AFP's effort to mobilize votes for Mitt Romney by drawing attention to an alleged rise in gas prices since President Barack Obama took office. But since most experts attribute the rise in gas prices to long term trends and crude oil commodity speculation, AFP's hijinks only underscore the role of Wall Street speculators -- including the Kochs themselves -- in jacking up critical commodity prices on average Americans.

AFP Subsidizing Gas to Woo Undecided Voters

The gas giveaway is part of AFP's larger "Obama's Failed Agenda" bus tour criss-crossing the nation from New Jersey to Wisconsin, where the group will spend the final days of the campaign.

AFP says the stunt is an attempt "To show just how bad policies lead to higher costs for American families," and places the blame for the rise in energy prices entirely on "Obama's policies." AFP New Jersey Director Steve Lonegan claims the increase in gas prices is due mostly to Obama's "radical, ideologically-driven 'green agenda' that has driven up gas prices to twice as high as they were four years ago," which is nearly identical to comments made by AFP directors in other states.

Gas Price Claims Deceptive, Misguided

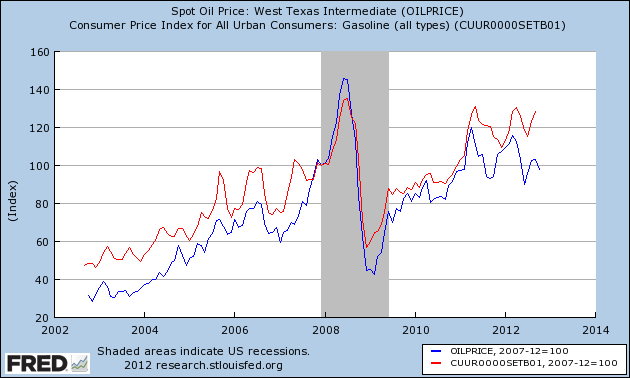

Throughout the early 2000s oil and gas prices had been following an upward trend, peaking in mid-2008 then plummeting briefly just before Obama took office as the result of the global economic downturn.

More importantly, AFP's energy campaign relies on the false notion that oil prices are determined strictly by the laws of domestic supply and demand: that prices would fall if only, somehow, the supply of oil were increased (perhaps by increased offshore drilling or the Keystone XL pipeline, both of which AFP supports).

In reality, the price of gas at the pump is determined by a host of other factors, particularly rampant speculation in the oil market which artificially drives up the price of oil, creating a new value based not on supply or demand, but on the intricacies of trading at any given time. An internal report published this year by Goldman Sachs estimates oil speculation may contribute as much as $20 to every barrel of crude oil.

Kochs Contribute to (and Profit From) High Gas Prices

While Koch Industries is a privately held company, evidence suggests that Charles and David Koch have profited enormously from the private, unregulated oil exchange market. The brothers are industry leaders in oil speculation and pioneered the first oil trading schemes in the 1980's. They have also artificially restricted the supply of oil by buying up large quantities of crude oil and holding it offshore in tankers -- hardly the behavior of a corporation concerned about "higher costs for American families."

Since the economic recession began in 2008, the Kochs [http://www.ifg.org/ have exponentially increased their wealth] by 58 percent while median family net worth dropped 40 percent. When fully implemented, the new Wall Street reform rules that bring transparency to the derivatives market might show us how much of this profit is due to oil speculation.

It is no wonder the Koch's fought hard to oppose it -- or why they are trying to put the blame for high gas prices elsewhere.

Comments

Anonymous replied on Permalink

Global Oil Scam

FBuckley replied on Permalink

GOP Oil Price Stunt

Terry Steward replied on Permalink

A Great Article

Texas Tom replied on Permalink

Article implicitly dismisses all of gas rise