Submitted by Wendell Potter on

You might not realize it, but this is National Small Business Week. I'm betting many small business owners aren't aware of it, either. Perhaps that's because most small business owners are far more likely to be worrying about whether they'll be able to offer health insurance to their employees for another year.

Or is this the year they join the ever-growing list of small businesses that have been "purged" by their insurance carrier?

Or is this the year they join the ever-growing list of small businesses that have been "purged" by their insurance carrier?

For several years now, insurance companies have been "purging" small business accounts they no longer consider profitable enough or that their underwriters believe pose too much risk. I became familiar with"purging" (yes, that's the actual word insurance executives use internally) toward the end of my career as an industry PR man.

Virtually unknown outside of a few executive suites until I disclosed it in testimony before the Senate Commerce, Science and Transportation Committee in June 2009, the practice is most prevalent at the big, for-profit insurance companies -- the ones that are under the gun to meet investors' profit expectations every three months. Along with "rescinding" (cancelling) the policies of individuals who become seriously ill, purging small businesses that employ workers who get sick is a tried-and-true way of meeting Wall Street's expectations.

All it takes is one illness or accident among employees at a small business to prompt an insurance company to hike the next year's premiums so high that the employer has to cut benefits, shop for another carrier or stop offering coverage altogether, leaving all their workers -- and their dependents -- uninsured.

Insurer's Purging Strategy: Intentionally Unrealistic Rate Increases

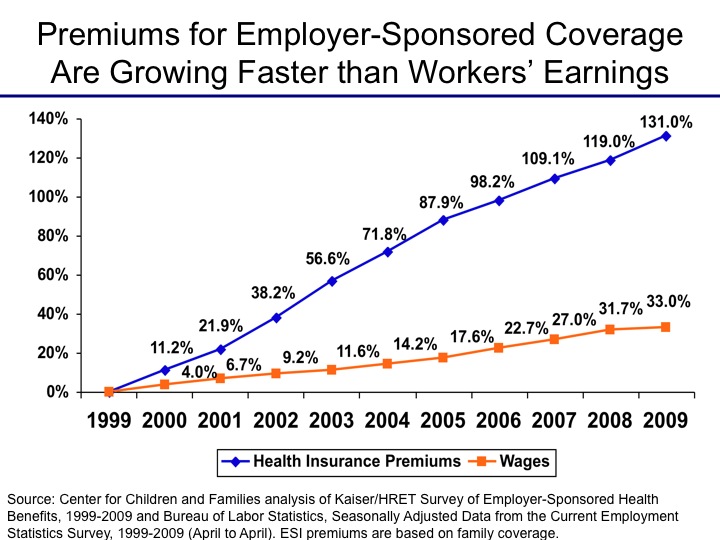

The purging of less-profitable accounts through intentionally unrealistic rate increases helps explain why the number of small businesses offering coverage to their employees has been declining for several years and why the number of Americans without coverage reached a record high of nearly 51 million last year. According to the National Small Business Association, the number of small businesses that provide health insurance to their employees fell from 61 percent in 1993 to 38 percent in 2009.

Dr. Ghanima Maassarani is the CEO of a small business who worries that her company may soon have no choice but to join the growing list of employers who no longer offer coverage.

Dr. Ghanima Maassarani is the CEO of a small business who worries that her company may soon have no choice but to join the growing list of employers who no longer offer coverage.

Maassarani's company, Inova Management, owns and operates several in-vitro fertilization centers throughout the United States. Her employees are mostly clinical professionals, including physicians. She shared a spreadsheet with me last week to show the rapid increase in premiums that her firm has had to endure in recent years.

In 2005, she was still able to pay the full monthly employee-only premium of $335 for all of her workers. The annual deductibles were comparatively modest: $500 for individuals and $1,000 for families.

When her insurer at the time, Aetna, proposed to raise the premiums at the end of the year, she switched to CIGNA, which offered her a lower monthly rate of $303 in exchange for a doubling of the deductibles. It turned out to be a one-year-only deal. Facing a substantial hike in premiums, Maassarani switched to UnitedHealth in 2007. She still had to pay more in monthly premiums for each employee than she had paid CIGNA -- $321 -- but the deductibles stayed the same.

Employers Held Hostage

Like CIGNA, UnitedHealth proposed a hefty rate increase at the end of the year. Rather than switch again, Maassarani chose to stay with UnitedHealth and swallow the additional 16 percent in 2008. To continue paying the full premium, however, she had to agree to double the deductible for her employees.

Twelve months later, UnitedHealth demanded a 22 percent increase for the following year. Maassarani agreed to UnitedHealth's demands, but had to have her employees pay a portion of the premium for the first time. She would pay $316; they would pay $110.

Then a child of one of her workers got very sick. That prompted UnitedHealth to jack up premiums 23 percent for 2010. To be able to continue offering coverage, she had to increase the cost sharing with her employees once again.

At the end of last year, UnitedHealth demanded yet another big increase, this time 20 percent. She is now paying $416.50 a month for each employee, and the employees are now paying $210.53 a month for a policy with a $2,000 individual and $4,000 family deductible.

So just since 2005, the cost of premiums for Inova has skyrocketed more than 87 percent. During that time, her employees have seen their share of the premium go from $0 to $210 a month -- while their deductible quadrupled.

Maassarani told me several of her workers are having a hard time paying their share. She expects some of them will drop coverage if they have to pay more next year. It's all but certain they will. And she acknowledged that she'll have to consider discontinuing health insurance as an employee benefit, a prospect she never imagined.

Maassarani told me several of her workers are having a hard time paying their share. She expects some of them will drop coverage if they have to pay more next year. It's all but certain they will. And she acknowledged that she'll have to consider discontinuing health insurance as an employee benefit, a prospect she never imagined.

If Maassarani throws in the towel, she will have fallen victim to purging, like so many other small employers before her. Meanwhile, U.S. health insurers are reporting record profits, and their CEOs are topping the list of highest paid corporate executives.

So much for celebrating National Small Business Week.