Spinning the Barrel

BP and the media express quantities of oil gushing from BP's leak in the Gulf in different ways. The amount of oil coming out of the leak is most frequently expressed in barrels, but how much is that? Can people really relate to a barrel as a quantity? After all, we buy staples like gasoline, milk, and water by the gallon. To make it even more complicated for the public to understand the quantities being discussed, the amount of liquid in a barrel varies with what is being measured. Barrels of chemicals or food, for example, contain 55 gallons. A whiskey barrel is 40 gallons; a barrel of beer contains 36 gallons; a barrel of ale contains 34 gallons. (And the latter two are imperial gallons, which are just under two-tenths more than an American gallon.) All these variations in the barrel as a quantity of measure only further confuse the concept of what a barrel of oil looks like. Moreover, since oil companies started shipping oil in tankers they rarely actually ship oil in barrels anymore, so the barrel as a measurement has less practical use.

BP and the media express quantities of oil gushing from BP's leak in the Gulf in different ways. The amount of oil coming out of the leak is most frequently expressed in barrels, but how much is that? Can people really relate to a barrel as a quantity? After all, we buy staples like gasoline, milk, and water by the gallon. To make it even more complicated for the public to understand the quantities being discussed, the amount of liquid in a barrel varies with what is being measured. Barrels of chemicals or food, for example, contain 55 gallons. A whiskey barrel is 40 gallons; a barrel of beer contains 36 gallons; a barrel of ale contains 34 gallons. (And the latter two are imperial gallons, which are just under two-tenths more than an American gallon.) All these variations in the barrel as a quantity of measure only further confuse the concept of what a barrel of oil looks like. Moreover, since oil companies started shipping oil in tankers they rarely actually ship oil in barrels anymore, so the barrel as a measurement has less practical use.

As the oil spill in the Gulf of Mexico continues to dominate headlines around the world, public outrage is being focused more intensely upon

As the oil spill in the Gulf of Mexico continues to dominate headlines around the world, public outrage is being focused more intensely upon

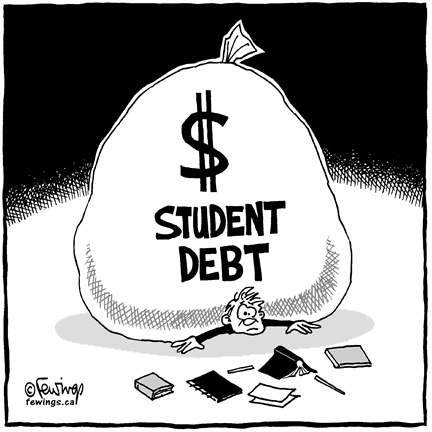

On every TV channel, commercials for schools like DeVry and the

On every TV channel, commercials for schools like DeVry and the  As per usual, when push comes to shove, the right-wing Israeli government, along with the

As per usual, when push comes to shove, the right-wing Israeli government, along with the  Reckless swaps and derivatives trading played a critical role in the financial crisis, inflating the domestic housing bubble and turning it into a global economic catastrophe. As the House and Senate conference committee begins final work on the financial services reform bill, it is critically important that we wall off the casino from the taxpayer guarantee. If big banks want to gamble they need to do so with their own money. Nobel prize-winning economist

Reckless swaps and derivatives trading played a critical role in the financial crisis, inflating the domestic housing bubble and turning it into a global economic catastrophe. As the House and Senate conference committee begins final work on the financial services reform bill, it is critically important that we wall off the casino from the taxpayer guarantee. If big banks want to gamble they need to do so with their own money. Nobel prize-winning economist