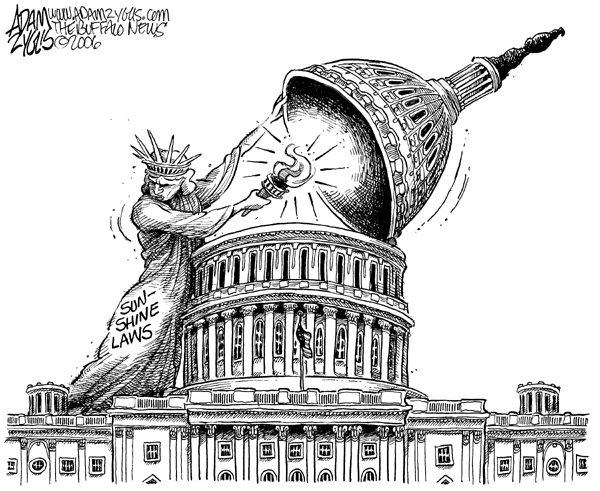

Corporations in Illinois: What Have You Got to Hide?

-by George Goehl, National People's Action

Tax fairness has become a centerpiece of national debate, from the president's reelection to the recent deal surrounding the so-called fiscal cliff. In Illinois, taxpayers want to make sure corporations in the State are paying their fair share as well. According to the Internal Revenue Service, the federal corporate tax rate from 1952-63 -- a period of prosperity and a significant rise in the middle class -- was 52 percent. Today it's 35 percent. By working loopholes and exceptions many corporations are able to reduce their effective tax rate to as low as zero. As it stands corporations doing business in Illinois do not have to disclose to the public what taxes, if any, they contribute to the state.

The U.S. House of Representatives is scheduled to vote Wednesday, May 30, on the Food and Drug Administration Reform Act of 2012,

The U.S. House of Representatives is scheduled to vote Wednesday, May 30, on the Food and Drug Administration Reform Act of 2012,  "Mr. Hodai had a history at the conference--not a very pleasant history. He was considered to be a persona non grata..."

"Mr. Hodai had a history at the conference--not a very pleasant history. He was considered to be a persona non grata..." "Over the last 17 years I have made every effort to engage the authorities in a constructive dialogue about the issue of non-pasteurized milk in Ontario and Canada. In return my farm has been raided by armed officers, my family has been terrorized and I [have] been dragged through the courts -- first being acquitted and then being found guilty.

"Over the last 17 years I have made every effort to engage the authorities in a constructive dialogue about the issue of non-pasteurized milk in Ontario and Canada. In return my farm has been raided by armed officers, my family has been terrorized and I [have] been dragged through the courts -- first being acquitted and then being found guilty. But don't tell that to the group of 100 or so protesters, who on Friday afternoon marched on the Marriott hotel in New Orleans, Louisiana (NOLA), where corporate lobbyists were voting with state lawmakers on "model" legislation at the

But don't tell that to the group of 100 or so protesters, who on Friday afternoon marched on the Marriott hotel in New Orleans, Louisiana (NOLA), where corporate lobbyists were voting with state lawmakers on "model" legislation at the  The event, hosted by People for the American Way and moderated by Center for Media and Democracy Executive Director Lisa Graves, was held directly across the street from

The event, hosted by People for the American Way and moderated by Center for Media and Democracy Executive Director Lisa Graves, was held directly across the street from