Submitted by Anne Landman on

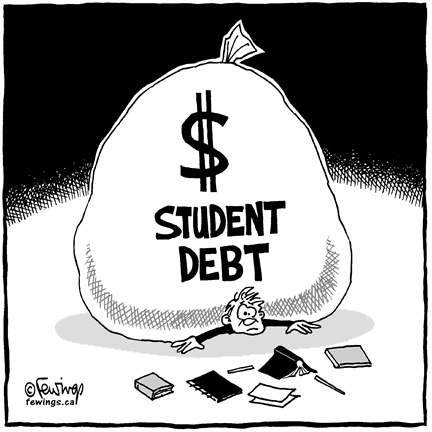

Ads for private, for-profit colleges and trade schools like the University of Phoenix, ITT Tech and Corinthian Colleges, Inc., lure students by leading them to believe that after graduation, they will land well-paying jobs that will help them get to a solid middle-class life. But graduates often end up seeing more bills than paychecks as they struggle to pay back massive student loans -- often at double-digit interest rates --after landing low-income jobs. A two-year associates degree at ITT Technical Institute, for example, costs around $40,000. The Le Cordon Bleu culinary school in Portland, Oregon arranged one student a loan of almost $14,000 that carried a a 13 percent interest rate and a $7,327 "finance charge." Experts say recruiters for these schools use aggressive, sometimes deceitful recruiting practices that can mislead students into poverty. The schools derive the bulk of their revenue from federal loans and grants, and the percentages have been climbing rapidly. The Apollo Group, which owns the University of Phoenix, derives 86 percent of its revenue from federal student aid sources, up from 69 percent two years earlier. Critics argue that these institutions profit at taxpayer expense while delivering questionable benefits to students. The Obama administration has floated a proposal to protect students from predatory practices by barring for-profit schools from loading them up with more debt that is justified by the salaries of the jobs they would likely pursue. The proposal has sparked fierce lobbying from the for-profit educational industry, which is pushing to maintain the status quo.

Ads for private, for-profit colleges and trade schools like the University of Phoenix, ITT Tech and Corinthian Colleges, Inc., lure students by leading them to believe that after graduation, they will land well-paying jobs that will help them get to a solid middle-class life. But graduates often end up seeing more bills than paychecks as they struggle to pay back massive student loans -- often at double-digit interest rates --after landing low-income jobs. A two-year associates degree at ITT Technical Institute, for example, costs around $40,000. The Le Cordon Bleu culinary school in Portland, Oregon arranged one student a loan of almost $14,000 that carried a a 13 percent interest rate and a $7,327 "finance charge." Experts say recruiters for these schools use aggressive, sometimes deceitful recruiting practices that can mislead students into poverty. The schools derive the bulk of their revenue from federal loans and grants, and the percentages have been climbing rapidly. The Apollo Group, which owns the University of Phoenix, derives 86 percent of its revenue from federal student aid sources, up from 69 percent two years earlier. Critics argue that these institutions profit at taxpayer expense while delivering questionable benefits to students. The Obama administration has floated a proposal to protect students from predatory practices by barring for-profit schools from loading them up with more debt that is justified by the salaries of the jobs they would likely pursue. The proposal has sparked fierce lobbying from the for-profit educational industry, which is pushing to maintain the status quo.

Comments

Hector Avellaneda replied on Permalink

Paying off student loan debt

Thanks for the sharing. I read about this on a CNN article not too long ago. Personally, I think for profit schools are doing a major disservice tot their student by allowing them to rack-up more student loan debt than the individual will make in a given year, after he graduates. I think there is one underlying problem, that has definitely become more evident in the last few years, and that is that there is a Financial Education crisis in America, When we go to school we learn about every subject imaginable, except about the subject of MONEY and how it really works. It's never taught to us in school and we definitely don't learn it from our parents because chances are that they're in debt as well. Today, the average college student goes to college in hoes of making a better living for themselves in the future and graduates in a worse financial position than they were when they first went to school. Financial Education is the key to designing a lifestyle that is truly worth living. Here is an article I wrote on a very similar topic, however, I offer my perspective on paying off student loan debt.